Acceptable Credit Score for a Home Equity Loan

Credit Scores and Home Equity Loans

Home equity loans can help homeowners pay for big expenses without having to refinance their homes or take out a personal loan. Instead, the equity in your home acts like a piggy bank, allowing you to take out a separate loan for a specific purpose (or, in the case of a HELOC, establish a credit line) and repay it over a longer period of time than other types of credit generally allow. It’s an affordable option for many people, but there are guidelines for underwriting home equity loans, and credit scores are included in that mix.

Tapping House Equity Made Easy

The guidelines for a home equity loan or HELOC aren’t as stringent as what you have to deal with when trying to qualify for an initial mortgage. This is because you already hold a considerable amount of equity in your house and you’re likely to have been there for years, so you have an established payment history. More importantly, you have an emotional bond with the place. The bank considers all of this when they’re trying to determine how well you’ll do with an extra credit line to pay back.

But, they also look at your credit score.

The score you’ll need to qualify for a home equity loan can vary from bank to bank and will definitely change depending on how much equity you have and how much you want to tap. If you only have 30 percent equity and you want to borrow as much as you can, you’re going to have to be pretty strong in the credit score department. However, if you have 70 percent equity in your home and only want to tap 10 percent, the banks may be a lot more flexible.

Credit Scores Affect Your Home Equity Loan

Although you can qualify for a home equity loan with a wide range of credit scores, most banks will want to see that you have a score over 620. That’s not to say that you can’t find a loan with a score below this, but in general, that’s sort of the minimum for standard products. Your interest rate will be tied to your credit score, so if you can do something to improve it before applying for a loan, like paying down debt, you’ll have a much better experience in the long run.

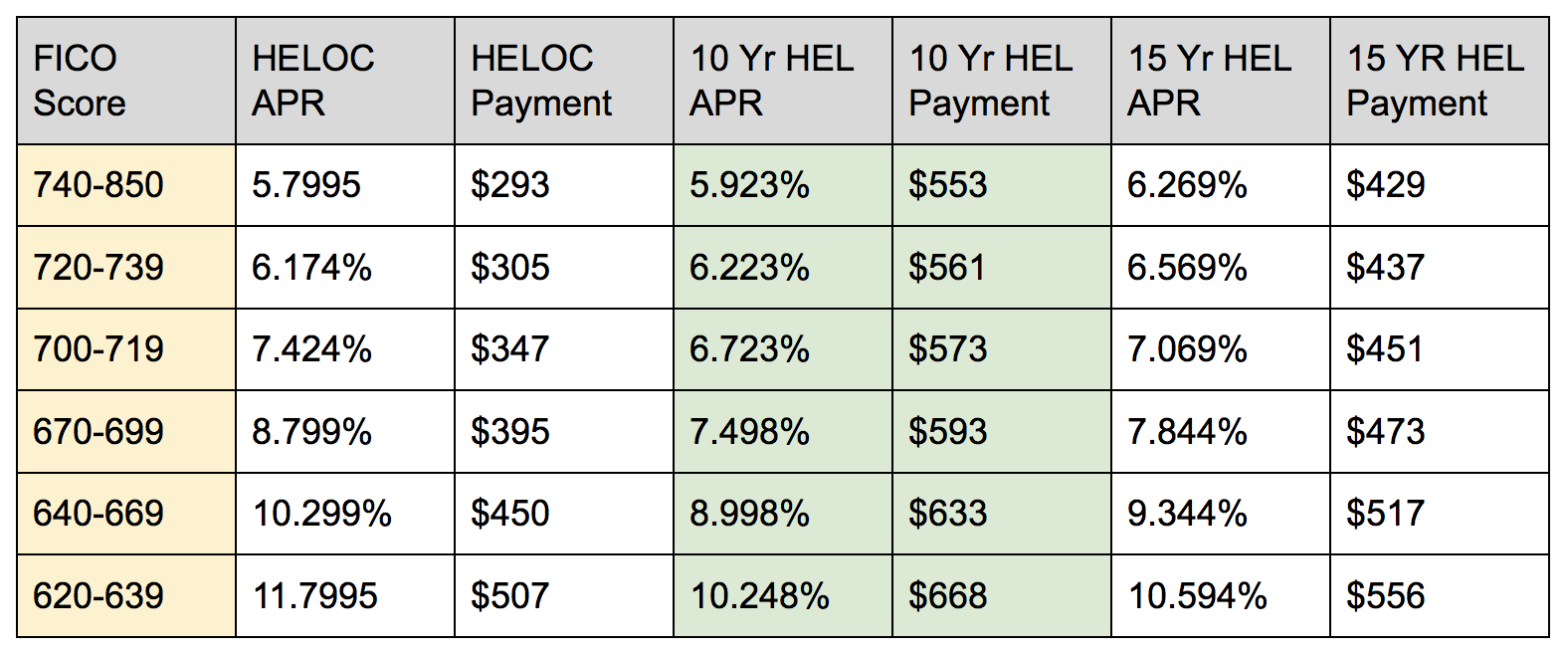

MyFICO has a home equity loan estimator on its website. This tool shows the differences between various credit tiers when it comes to your home equity loan payment. The table below is just an example, based on data available at the time of this writing.

Cost of Borrowing $50k with Various Credit Scores

As you can see from the chart above, having a good credit score can make a huge difference. But even if your credit is less than perfect, you can use it to help make a few decisions about the best home equity loan for your credit tier. If you’re in the lowest tier, 620-639, for example, your lowest payment is with the HELOC, but your best interest rate is with a 10-year home equity loan.