What Is the Difference Between a Conventional Loan and an FHA Loan?

The Differences Between a Conventional Loan and an FHA Loan

A conventional home loan and an FHA loan are both mortgage products that make it possible for home buyers to finance the purchase of a house. While they both help prospective home buyers to get the funding they need to buy a house, they have very different qualities, requirements, and terms.

Conventional Home Loans vs. FHA Loans

The main difference between a conventional home loan and an FHA loan is that an FHA loan is insured by the federal government, whereas a conventional loan is not. If a borrower of a conventional loan stops making payments on their mortgage, the lender (usually a bank or credit union) suffers this loss. If the borrower of an FHA loan stops making payments, the federal government backs the loan so that the lender doesn’t have to take a loss.

From the home buyer’s perspective, the fact that the FHA loan is government-backed doesn’t matter too much. However, for the lender, having the government’s guarantee in place makes the bank or credit union far more likely to lend to a riskier home buyer -- like one with bad credit, for example.

Deciding if a Conventional or FHA Loan is Right for Me

When you’re ready to apply for a mortgage, you’ll likely be wondering whether you’re better off with a conventional loan or an FHA loan. Before you get elbows-deep in your comparison, it’s important to note that what you want and what you can qualify for may be two completely different things. Here are a couple of important questions to ask yourself when comparing different types of home loans:

How much of a down payment can I make?

While the FHA loan program requires very little in the way of a down payment (3.5%), you’ll need closer to the standard 20% to obtain a conventional loan. You may still be able to get a conventional mortgage with less than 20% down, but you may have a hard time finding a lender who will offer you this loan product (and you’ll be required to pay private mortgage insurance, or PMI).

Am I creditworthy enough to qualify for a conventional mortgage?

A conventional home loan typically has stricter credit requirements than an FHA loan. If you have a history of late payments, a high debt-to-credit ratio, or any bankruptcies or liens to your name, you may not qualify for a conventional mortgage.

When it comes to credit scores, every lender will have their own criteria. Generally speaking, though, you’ll need at least a 740 to qualify for a conventional loan. By contrast, FHA lenders will provide loans to those with scores as low as 580.

To get more information on how to improve your credit score, find out which items are negatively impacting your creditworthiness by obtaining a free report from annualcreditreport.com. You may also find your credit score using a free site like Credit Karma.

Loan Terms for Conventional Loans vs. FHA Loans

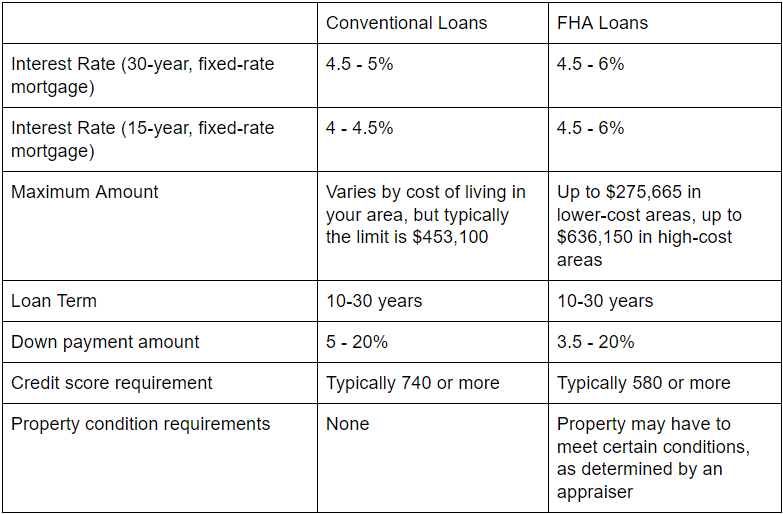

Generally, a conventional loan will have better terms for a borrower, but they’re also more difficult to qualify for. Here’s a comparison of the loan terms for conventional loans and FHA loans.