Everything You Need to Know About Doctor Home Loans

Doctors get all the good stuff: highly communicable diseases, giant student loan debt, and around-the-clock work responsibilities. In seriousness, doctors are heroes -- and mortgage lenders have caught on that student loan debt can be incredibly crippling to doctors when it comes to obtaining a home loan.

Enter the non-conforming mortgage commonly called the “Doctor Home Loan.” If you’re a doctor who has been struggling to qualify for a conforming conventional mortgage, this mortgage designed for doctors may be the solution you’ve been looking for.

What is a Doctor Home Loan?

It’s a well-known fact that most doctors do pretty well when it comes to yearly income. But that may not stand for much when you consider how student loan debt is a massive burden for young MD’s still deep in their residencies or just finally finishing up. However, a few banks crunched the numbers and found that as a demographic, doctors default less than other new homeowners, making them much less of a risk despite their student loan hijinks.

These banks aren’t shy about offering their doctor home loans to any and every medical school grad they can find. On that note, it’s important to consider that these are non-conforming mortgages, which means that they can’t be bought by Fannie Mae or Freddie Mac and that there are really no rules about writing them. Each bank can define its own policy on who gets a “doctor mortgage” and who doesn’t.

Non-conforming mortgages can be dangerous and slippery, so make sure to read all the paperwork before you sign anything at all. Here’s everything you need to know about doctor home loans in order to make the right decision for your and your family.

Features of a Typical Doctor Home Loan

For some medical professionals (and those soon to be fully licensed), the idea of moving from a rental to your own place is incredibly appealing. You might be willing to accept a mortgage that has the potential to be a little more expensive than other options, in the event that you can get approved right now.

A doctor home loan is different from other mortgages because of features like:

No down payment. That’s right. You don’t need any cash upfront to get into a house of your choice right now. This hook is an incredible temptation, but does come with caveats. For example, before the real estate market crash in the mid 2000s, zero-down loans were taken out by every sort of borrower. Some borrowers went deep underwater, while others were just treading (since they intended to stay in their home for the long-term).

Overlooking student loan payments. Depending on how you’ve got your student loans set up, all or most of the payment can be ignored by doctor mortgage lenders. This dramatically reduces your debt-to-income ratio, making it a cinch to qualify for a loan. Just be sure you only borrow what you can really afford because those student loans won’t let you actually ignore them for long.

Absolutely no mortgage insurance. This is good for you, but not so good for the bank if you default. PMI costs most borrowers anywhere from about a half a percent to one and half percent of their mortgage balance each year. That may not sound like much, but even at a half percent, your monthly mortgage insurance payment on $400k would be $167!

Using forecasted income to determine loan amount. Instead of asking for W-2s and employment history, doctor home loans look forward, especially if you’re still a resident or fellow. You might only be making $40k right now, but banks trust that your income will grow. If you have an employment contract, they’ll happily take that as evidence of earning potential.

Painless and inexpensive jumbo options. Typically, getting a jumbo mortgage is a big deal (no pun intended). Regular folks need as much as 30% down, and the home is heavily scrutinized, as is the borrower. It’s not as hard to get a jumbo as a doctor, and it costs the same amount as a smaller mortgage.

As you can see, doctor home loans are very different from regular conforming conventional loans, or any standard mortgage in the market right now. Of course, you have to be a doctor to get one, and not just any sort of doctor. These loans are limited to docs with these credentials:

MD. Medical doctors.

DO. Doctor of Osteopathy

DDS or DMD. Dentists of all varieties.

DVMM. Veterinarians.

DPM. Podiatrist (some lenders)

OD. Optometrists (some lenders)

And by the way, you usually have to grab these loans within three years of graduation from medical school, so there’s a lot to keep up with when it comes to qualifying for a doctor mortgage loan.

Pros and Cons of Doctor Home Loans

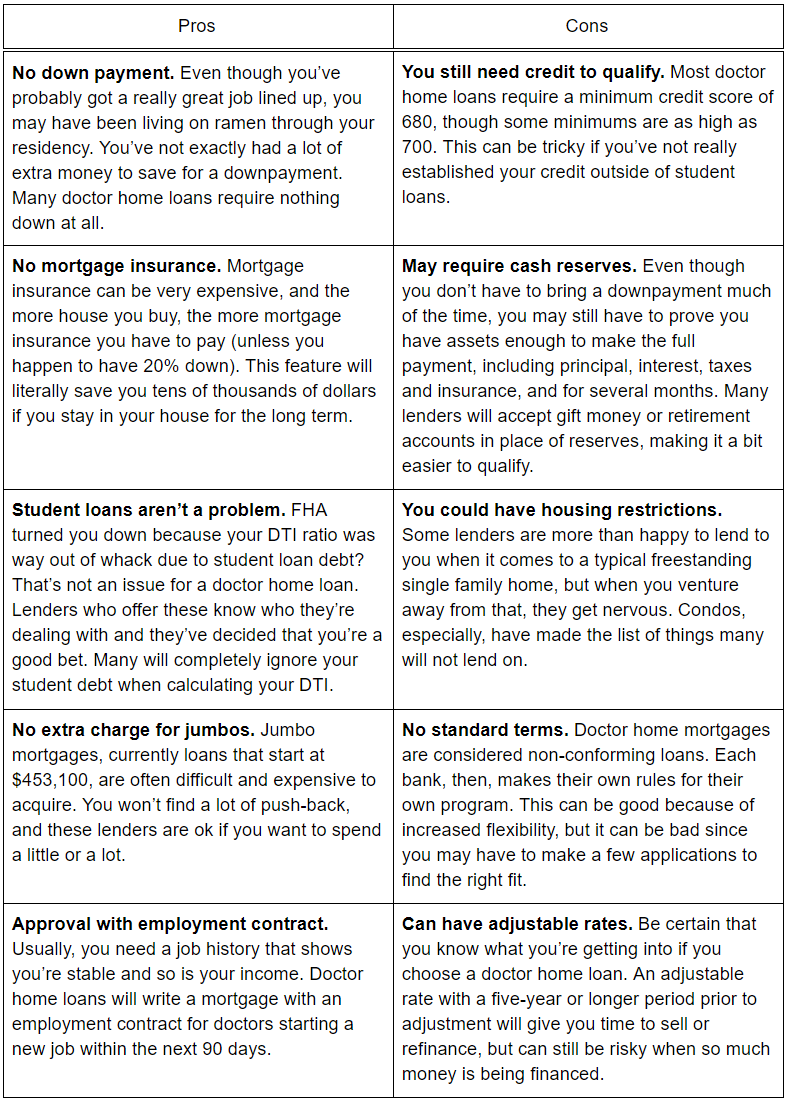

Doctor home loans aren’t like any other loans, so comparing them side-by-side can be a little tricky. Still, for many doctors who are determined to stay in one place for at least five years, these mortgages could represent stability and security over the long term. Let’s look at the major pros and cons of doctor mortgages.

Who Qualifies for a Doctor Loan?

The perfect borrower for a doctor home loan is a doctor -- but not just any doctor will do. These loans are designed specifically for young doctors just starting out, though some lenders will give money to any doctor that qualifies. Terms like low- to zero-down payments and practices like ignoring student loan debt in debt-to-income calculations mean that fresh-faced docs have an easier time getting the money they need to buy a house.

The perfect borrower for a doctor loan is someone who:

Is a resident, fellow, or doctor early in their career.

Has a good credit score (680 or higher)

Has a job lined up to start within the next 90 days.

Intends to stay in their home for three to five years, minimum.

Can temper their expectations in a first home and not overspend.

It’s important to realize that buying a home with no down payment means you can’t just pick up and run if you get a job offer across the country. The reason? It takes time to start paying down the principal on a loan that’s amortized the way mortgages are. It doesn’t matter how good your rate is, you’re going to have to put in some time, both for your payments to make a dent and for your local market to naturally inflate enough that you can sell when the time is right.

Doctor Mortgage or Something Else?

Maybe a doctor mortgage isn’t everything you’d hoped it would be, or you’d at least like to know how one compares to other loan programs. Let’s break it down.

Comparing Doctor Mortgages to Other Mortgage Types

According to the chart, there aren’t a lot of differences between doctor mortgages and other types, but the differences that do exist are significant. The lack of mortgage insurance makes doctor home loans cheaper than anything else, even if you have to pay a slightly higher rate. Remember that FHA borrowers pay a minimum of 0.80% of the balance each year as mortgage insurance, plus a 1.75% upfront fee (which can be financed, so you’re actually paying mortgage insurance on mortgage insurance…). Even a good conventional loan will require around 0.64% each year in mortgage insurance.

The costs of mortgage insurance alone is incredible. Here’s what that looks like:

Assuming that your doctor home loan has a rate similar to the going rate for an conventional or FHA mortgage, your savings can be enormous. But again, it’s an effect that only gets better with time. If you’re transferred or you relocate in a year or two, the savings aren’t so great and you’ll possibly be in real trouble.

Doctor Loans: Wrapping It All Up

Doctor home loans are programs designed by individual mortgage banks that have found the demographic to be particularly appealing as customers due to their low default rate and high income potential, coupled with a difficulty to get a mortgage because of all of the student loans it took to get through medical school. It’s not exactly a benevolent offering, since lenders are out to make money: but these loans can certainly be used to your advantage if you have a long term plan already ironed out.

If you’re ready to find a doctor mortgage that’s right for you, let us help. The process can be tedious because of so many different lender requirements, but luckily we have the inside scoop. We’ll help you find the doctor home loan that’s ideal for you and your purchase goals, cutting out all the rigmarole and stress that comes with multiple rejections. Contact us today here at Home.Loans so you can start your home search tomorrow.